In the fast-paced world of real estate, mastering negotiation is key to securing exceptional deals, especially with cash offers. Whether you’re a buyer aiming for your dream home or a seller wanting top dollar, knowing how negotiating a cash offer on a home works is essential.

Let’s face it—buying or selling a home isn’t just another item on your to-do list; it can be a rollercoaster of emotions, from the thrill of sealing a fantastic deal to the nail-biting anxiety of negotiations. Maybe you’re here because you dream of financial freedom, or perhaps the idea of outsmarting the market gives you a rush. Whatever your reason, you’re in the right place.

Imagine navigating the world of cash offers armed with insider tips and a dash of confidence, flipping the script from “What if I mess up?” to “Watch me ace this!” Ready to turn those real estate jitters into a triumphant victory dance? This guide to negotiating a cash offer on a home equips you with practical tips, effective strategies, and insider secrets. Let’s get started!

What is a Cash Offer?

If you’ve ever looked into selling your home quickly, you’ve probably come across ads or websites from companies promising to “sell my home fast.” These offers might sound too good to be true, but they often revolve around what’s known as a cash offer. So, what exactly does that mean for you as a seller?

A cash offer is made by a buyer who intends to pay for the property in full with their own funds. This means there’s no need for the buyer to secure financing from a bank or mortgage lender. As a result, the transaction can proceed more quickly and with fewer hurdles than a financed purchase. This can be a huge relief for sellers looking for a smooth and speedy sale.

How ‘Sell My Home Fast’ Companies Operate

While the promise of selling your home fast is tempting, it’s essential to understand how these companies typically operate. Many of these companies are not direct buyers. Instead, they act as brokers. Here’s what that means:

- Connecting Sellers with Cash Buyers: These companies often have a network of investors and cash buyers. When you contact a “sell my home fast” company, they evaluate your property and then connect you with one or more interested cash buyers from their network.

- Earning a Fee from the Buyer: The company usually earns a fee for facilitating the transaction. This fee is paid by the actual buyer, not you, the seller. Essentially, the company acts as a middleman, ensuring that the deal goes through smoothly and quickly.

- Brokerage Role: Instead of purchasing your home outright, these companies broker the deal, handling negotiations and paperwork to streamline the process for you and your buyer.

Why Understanding This Distinction Matters

Knowing that these companies are brokers rather than direct buyers can influence how you approach the sale of your home. Here are some tips to ensure a trustworthy and beneficial experience:

- Research the Company: Look for reviews and testimonials from other sellers who have used their services. This can give you insight into their reliability and the experiences of other homeowners.

- Ask Questions: Don’t hesitate to ask the company how they operate, who their typical buyers are, and what fees are involved. Transparency is key to a smooth transaction.

- Get Multiple Offers: Consider reaching out to several companies to compare offers and services. This can help you find the best deal and ensure you’re getting fair market value for your property.

- Understand the Timeline: Make sure to get a clear understanding of the expected timeline for the sale. This can help you plan your next steps and ensure that the process aligns with your needs.

By understanding how “sell my home fast” companies operate and taking steps to evaluate them carefully, you can make more informed decisions and navigate the sale of your home with confidence.

Benefits of Working with a Direct Buyer

Choosing to work with a direct buyer like Grapevine can offer significant advantages over dealing with a broker, primarily because it eliminates the middleman. Here’s how this can benefit you:

- More Cash for You: Without a broker’s fee cutting into the transaction, you can potentially receive more money directly from the sale. This means more cash in your pocket.

- Streamlined Process: Dealing directly with a buyer can simplify the process. There’s no need to go through an intermediary, which can make communications and negotiations more straightforward and efficient.

- Reduced Fees: By eliminating the middleman, you also eliminate associated fees that brokers might charge for their services. This can result in significant savings.

- Better Deals: Direct buyers might be more willing to negotiate favorable terms since they are not paying an additional fee to a broker. This can lead to a better overall deal for you as the seller.

Cash is King: Why Cash Offers Stand Out

In the world of real estate, cash truly is king. Imagine walking into a negotiation armed with the undeniable allure of a cash offer. The advantages are plentiful and powerful, beginning with the speed of the transaction. Unlike financed offers that can drag on for weeks as buyers await loan approvals, cash deals can close in a matter of days. This expedited process is a breath of fresh air for sellers eager to move on to their next chapter, making a cash deal all the more appealing.

But the perks don’t stop there. Cash offers come with fewer contingencies, simplifying the transaction for both parties. There’s no need to worry about appraisal issues or financing falling through at the last minute. This certainty and simplicity can be a significant stress reliever for sellers, who often prefer the straightforward nature of cash deals.

Take, for instance, the story of The Boyd Family, two homeowners looking to sell their property quickly due to a job relocation. They received multiple offers but ultimately chose the cash offer, even though it was slightly lower than a competing financed bid. Why? Because the cash buyer could close within a week, allowing Jane to transition smoothly to her new city without the looming uncertainty of a delayed sale.

The Growing Trend of Cash Buyers

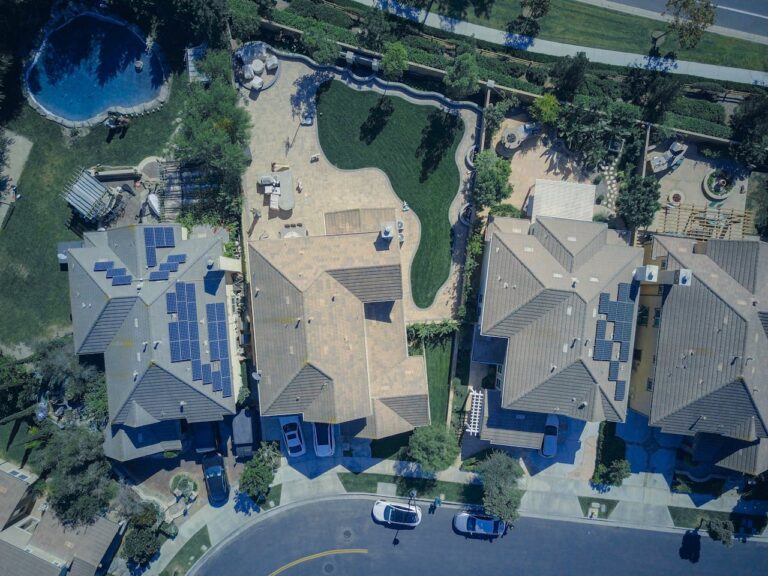

Since October 2022, more than one-quarter of home buyers have been all-cash buyers, and as of January 2024, this figure has risen to 32% of home sales. In fact, this is the highest share of cash buyers since June 2014, reflecting the growing trend and appeal of cash transactions in the market.

For home sellers, 2024 has shown some notable trends. The median sale price for an existing home in the U.S. hit a record-high $419,300 in May 2024, indicative of the robust market conditions. Additionally, home sellers were more active in July 2024, with 3.6% more homes newly listed on the market compared to last year. These statistics highlight the dynamic nature of the real estate market and the opportunities for sellers to capitalize on current conditions. For more detailed information, check out the recent home seller statistics.

Moreover, cash offers can provide buyers with a competitive edge in a hot market. Sellers frequently favor these offers because they eliminate the risk associated with mortgage approvals and the potential for deal collapse. This preference means that, when multiple bids are on the table, a cash offer often rises to the top, even if it’s not the highest bid.

How Does a Cash Offer Differ from a Financed Offer?

The primary difference between a cash offer and a financed offer is the source of funds. In a financed offer, the buyer relies on a loan from a financial institution to cover most of the purchase price. This process involves several steps, including loan approval, appraisal, and underwriting, which can extend the timeline of the transaction and introduce potential complications.

In contrast, a cash offer bypasses these steps, as the buyer already has the funds available. This can streamline the process, reduce the risk of delays, and often results in a quicker closing.

Show Me the Money: Evaluating Cash Offers

As a home seller, receiving a cash offer can be an exciting and advantageous scenario. Here’s a comprehensive guide to help you evaluate and respond to cash offers effectively:

1. Verify the Buyer’s Funds

The first step in evaluating a cash offer is to verify that the buyer has the financial resources to complete the purchase. Request a proof of funds letter from the buyer’s bank or financial institution. This document will confirm that the buyer has the necessary cash reserves and adds a layer of security, ensuring that the transaction is viable and that you are dealing with a serious buyer.

2. Understand the Market Value of Your Property

Before responding to a cash offer, it is crucial to understand the market value of your property. Conduct a comparative market analysis (CMA) to evaluate similar properties in your area. Knowing the market value helps you assess if the cash offer is fair and competitive. This knowledge also empowers you to negotiate confidently, ensuring you don’t undervalue your property.

3. Assess the Benefits of a Quick Closing

One of the most significant advantages of a cash offer is the potential for a quick closing. Unlike financed buyers who may need 30-45 days to close due to loan processing, a cash buyer can often close within a week. This speedy transaction can be particularly advantageous if you need to relocate quickly or are eager to finalize the sale and move on to your next chapter.

4. Negotiate Terms That Align with Your Goals

While reviewing a cash offer, consider negotiating terms that align with your goals. For instance, you might negotiate for a higher purchase price, flexible move-out dates, or the buyer covering some of the closing costs. Communicate clearly with the buyer or their agent to ensure that the terms are mutually beneficial and meet your needs.

5. Leverage the Strategic Advantages of Cash Offers

Cash offers come with fewer contingencies, simplifying the transaction for both parties. There’s no need to worry about appraisal issues or financing falling through at the last minute. This certainty and simplicity can be a significant stress reliever. Use these strategic advantages to your benefit in negotiations. Highlight the appeal of a straightforward, hassle-free closing process when discussing terms with the buyer.

By following these steps, you can effectively evaluate and respond to cash offers, maximizing the benefits and ensuring a smooth transaction. Being prepared, strategic, and leveraging the strengths of cash offers can help you achieve your selling goals efficiently.

Avoiding Pitfalls: Common Mistakes and How to Avoid Them

Navigating the process of selling your home, especially when considering cash offers, can be complex. Here are some common mistakes sellers make and practical advice on how to avoid them:

Overlooking Hidden Fees

Although cash offers can seem straightforward, there may be hidden fees involved that can reduce your net proceeds from the sale.

How to Avoid It:

- Read the Fine Print: Carefully review all terms and conditions of the offer. Pay attention to any fees or costs that you may be asked to cover.

- Consult with a Trusted Cash Buyer: If you’re unsure about any aspect of the offer, consulting with Grapevine Capital can help you uncover any hidden fees and understand the financial implications.

Failing to Understand the Terms of the Offer

Misunderstanding the terms of a cash offer can lead to unexpected complications and disappointments.

How to Avoid It:

- Seek Clarification: Don’t hesitate to ask the buyer or your real estate agent for clarification on any terms you don’t fully understand.

- Get Everything in Writing: Ensure that all agreements, including contingencies and timelines, are documented in writing to avoid any miscommunication.

Not Considering the Impact of a Quick Sale

While a quick sale can be appealing, especially with a cash offer, it’s important to understand how it aligns with your personal timeline and financial goals.

How to Avoid It:

- Evaluate Your Needs: Consider your personal situation, such as moving timelines and financial requirements. Ensure that a quick sale aligns with your overall plans.

- Negotiate Terms: Don’t be afraid to negotiate terms that better suit your needs, such as a later closing date if you need more time to move.

Not Being Upfront About the Condition of the Home or Necessary Repairs

Failing to be transparent about the condition of your home can lead to trust issues, renegotiations, or even deal cancellations. Buyers don’t appreciate surprises, especially costly ones.

How to Avoid It:

- Disclose Known Issues: Be honest about any problems or repairs that need to be addressed. Full disclosure can build trust and set realistic expectations.

- Consider a Pre-Inspection: Having a pre-inspection done can identify potential issues before listing your home. This allows you to address problems proactively or adjust your pricing accordingly.

- Provide Repair Estimates: If there are significant repairs needed, consider providing estimates to potential buyers. This transparency helps buyers understand the scope and cost of necessary work.

By being aware of these common pitfalls and taking proactive steps to avoid them, home sellers can navigate cash offers more confidently and successfully. This approach ensures a smoother transaction and helps maximize your financial return.

The Final Countdown: What Happens After the Offer?

So, you’ve accepted a cash offer on your home – congratulations! But what happens next? Here’s a step-by-step guide to help you navigate the final stages of the sale process smoothly and confidently.

Signing the Purchase Agreement

Once you accept the cash offer, the next step is to sign the purchase agreement. This legally binding document outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies.

Tips for Success:

- Review Thoroughly: Read the agreement carefully and ensure all details are correct. If you have any questions, consult with your real estate agent or attorney.

- Get It in Writing: Make sure all verbal agreements are included in the written contract to avoid misunderstandings.

Scheduling Inspections (If Applicable)

Even with a cash offer, the buyer may want to conduct a home inspection to ensure there are no major issues with the property. This step can identify any necessary repairs or adjustments to the agreement.

Tips for Success:

- Prepare Your Home: Ensure your home is clean and accessible for the inspector. This can help the inspection go smoothly and quickly.

- Be Transparent: If an inspection reveals issues, discuss them openly with the buyer. You may need to negotiate repairs or adjust the sale price accordingly.

Handling Contingencies

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include inspections, appraisals, or the buyer’s review of homeowner association documents.

Tips for Success:

- Stay Organized: Keep track of all contingencies and their deadlines. Missing a deadline can delay the closing process or even jeopardize the sale.

- Communicate Clearly: Maintain open communication with the buyer and your real estate agent to resolve any issues promptly.

Preparing for Closing

As the closing date approaches, there are several important tasks to complete to ensure everything goes smoothly.

Tips for Success:

- Complete Necessary Paperwork: Work with your agent to ensure all required documents are filled out accurately and on time. This includes the title transfer, disclosure forms, and any other legal paperwork.

- Clear Outstanding Debts: Pay off any outstanding property taxes, liens, or utility bills to avoid complications at closing.

- Schedule Moving Plans: Make arrangements for your move, including hiring movers and notifying utility companies of your move-out date.

Staying Organized and Communicating

Throughout the final stages of the sale, staying organized and maintaining communication is crucial.

Tips for Success:

- Create a Checklist: Make a checklist of all tasks to be completed before closing. This can help you stay on top of deadlines and ensure nothing is overlooked.

- Stay in Touch: Regularly communicate with your real estate agent, the buyer, and any other parties involved in the transaction to keep everything on track.

What to Expect on Closing Day

Closing day is when the sale is finalized, and ownership of the property is transferred to the buyer. Here’s what typically happens:

- Sign Documents: Both you and the buyer will sign the final paperwork, including the deed and settlement statement.

- Transfer Funds: The buyer will transfer the agreed-upon funds to you, often through a title company or escrow agent.

- Hand Over Keys: Once the paperwork is signed and funds are transferred, you’ll hand over the keys to the new owner.

- Celebrate: With the deal closed, it’s time to celebrate your successful sale and start your next chapter!

By following these steps and staying proactive, you can ensure a smooth and efficient closing process. Congratulations on selling your home!