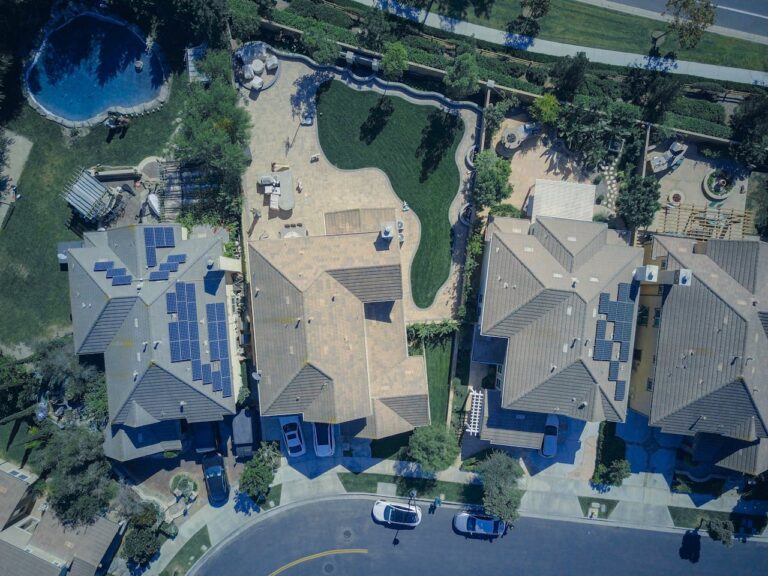

In today’s fast-paced world, financial stability can sometimes feel like a distant dream. Many people are grappling with mounting debts and monthly expenses that seem to never end. If you find yourself nodding along, you’re not alone. The idea of selling your home to slash debt might have crossed your mind. But is it the right move for you? This article will explore the pros and cons, offering insights into whether home selling could be your ticket to financial freedom.

The Weight of Financial Stress

Financial stress can take a toll on your well-being. It disrupts sleep, strains relationships, and can even impact your health. But before you make a drastic decision, consider the full picture. Struggling with costs can be overwhelming, but selling your home is a significant step. Let’s explore this option further.

Is Selling Your Home to Slash Debt Wise?

Selling your home might seem like a quick fix to erase debt. However, it’s essential to weigh the potential benefits against the drawbacks. When you sell your home to slash debt, you’re committing to a major lifestyle change. But, could this move be the relief you need?

Pros of Selling Your Home:

- Immediate Debt Relief: Selling can provide a lump sum to clear large debts.

- Freedom from Mortgage Payments: Reducing monthly expenses can free up cash flow.

- Potential for New Beginnings: Downsizing or renting might open up new opportunities.

- Cons of Selling Your Home:

- Loss of Stability: Moving can be stressful and disruptive.

- Market Dependency: Selling price depends on market conditions.

- Emotional Attachment: Letting go of a home can be emotionally challenging.

Exploring Alternatives

Before you put up that “For Sale” sign, consider other ways to manage your debt. Re-evaluate your budget, negotiate with creditors, or look into refinancing options. Sometimes, a cash offer from a home buyer might not be necessary if there are alternative solutions.

Why Consider a Cash Offer?

A cash offer can be tempting because it promises speed and certainty. When dealing with financial pressure, the allure of a quick transaction is strong. But is it right for you? Here’s what you need to know.

- The Speed of Cash Offers: Cash offers can close in days, providing immediate funds.

- Certainty of Sale: No concerns about buyer financing falling through.

- Avoiding Repairs: Cash buyers often purchase “as-is,” saving you repair costs.

Making an Informed Decision

If you’re considering selling your home, it’s crucial to make an informed decision. Weigh your options, assess your financial situation, and consult with professionals. Realtors, financial advisors, and legal experts can offer guidance tailored to your unique circumstances.

Questions to Guide Your Decision

To help clarify your path, ask yourself these questions:

- What are my long-term financial goals?

- Can I afford the costs of selling, such as agent fees and moving expenses?

- What alternative solutions exist for managing my debt?

The Emotional Aspect of Selling Your Home

Let’s not forget the emotional side of selling a home. It’s more than just a transaction; it’s about leaving memories behind. Understanding the emotional impact can help you prepare for the change.

Preparing for the Emotional Impact

- Acknowledge Feelings: It’s natural to feel attached to your home.

- Focus on the Future: Look forward to new experiences and opportunities.

- Seek Support: Talk to friends and family or consider professional support.

Resources for Further Guidance

If you’re ready to sell your home to slash debt, or even if you’re just exploring the idea, these resources can provide valuable insight:

The Bottom Line: A Path to Financial Freedom

Ultimately, deciding to sell your home to slash debt is a deeply personal choice. It’s about finding balance and creating a path toward financial freedom. By carefully considering your options and seeking professional advice, you can make a decision that aligns with your goals and circumstances. Remember, you’re not alone in this journey. Many have walked this path before and found their way to a brighter financial future.