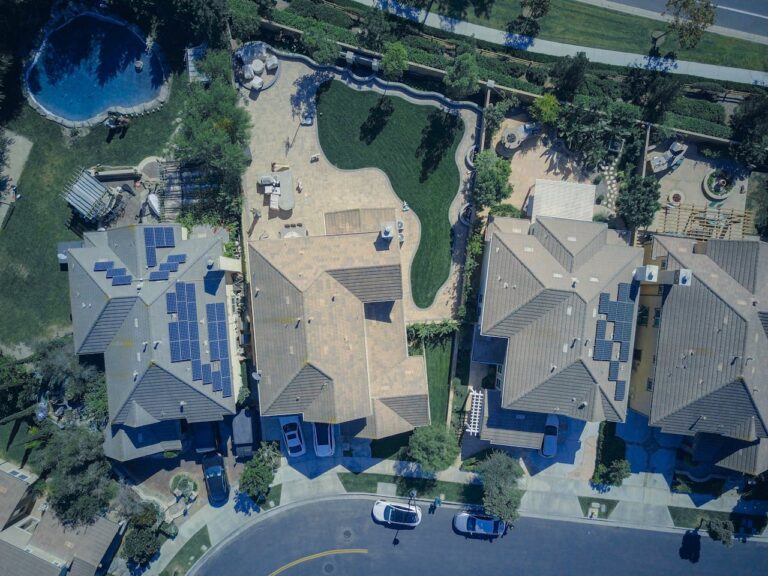

What if I told you that the journey to owning a home begins with just one powerful step? This step is known as the Down Payment, a crucial element in turning the dream of homeownership into reality. Whether you’re a first-time buyer or a seasoned real estate investor, understanding the ins and outs of down payments can dramatically shape your financial landscape. So, what exactly is a down payment, and why is it so important? Let’s dive into this foundational concept and discover how it paves the way to securing your dream home.

What is a Down Payment?

At its essence, a Down Payment is the initial amount of money paid when purchasing a home. It’s the portion of the purchase price that you pay out of pocket, with the remainder typically covered by a mortgage. Imagine it as your financial handshake—a commitment signaling your intent to purchase the property. This payment is made upfront and is often expressed as a percentage of the home’s total price.

But why does it matter? For lenders, a significant down payment reduces their risk. For buyers, it lowers the overall loan amount, potentially resulting in better mortgage terms. It’s a win-win for both parties involved, setting the stage for a smooth transaction.

The Importance of a Down Payment

Why is the Down Payment so pivotal in real estate? Here are a few reasons why it holds such significant weight:

- Reduces Loan Amount: The larger the down payment, the smaller the loan you’ll need. This not only reduces the amount of interest paid over the life of the loan but also can lead to lower monthly payments.

- Impacts Interest Rates: A substantial down payment can help you secure more favorable interest rates. Lenders often view higher down payments as a sign of financial stability, translating into better loan terms.

- Avoids Private Mortgage Insurance (PMI): By making a down payment of 20% or more, buyers can avoid PMI, saving on additional monthly costs.

- Builds Immediate Equity: The down payment instantly gives you equity in the property, reflecting your ownership stake in the home.

How to Calculate Your Down Payment

Calculating your Down Payment is a straightforward process but requires careful planning. Here’s how you can determine how much you’ll need:

- Determine the Home Price: Start by identifying the price range for homes you’re considering. This sets the foundation for your calculations.

- Set a Percentage Goal: Most lenders require a minimum of 3% to 20%. Decide what percentage of the home price you aim to put down. The larger the percentage, the better the terms you might secure.

- Calculate the Amount: Multiply the home price by your chosen percentage. For example, for a $300,000 home with a 10% down payment, you’ll need $30,000.

- Consider Additional Costs: Don’t forget to account for closing costs and other expenses when budgeting for your down payment.

Role of Down Payment in Real Estate Transactions

In the realm of real estate, the Down Payment serves as more than just a financial obligation. It’s a tactical move that can influence every aspect of the transaction:

- Negotiation Power: A substantial down payment can strengthen your bargaining position, signaling seriousness to sellers and potentially leading to better deals.

- Loan Approval: Lenders assess your down payment alongside your credit score and income to determine loan eligibility. A strong down payment often results in quicker approvals.

- Financial Planning: Understanding your down payment requirements helps in crafting a realistic budget, ensuring you’re financially prepared for home ownership.

Embracing the Down Payment Advantage

As you embark on the path to homeownership, recognize the Down Payment as your powerful ally. It’s more than just a financial hurdle; it’s a strategic tool that opens doors to opportunities and advantages in the real estate market. By mastering the nuances of down payments, you position yourself as an informed buyer, ready to navigate the complexities of purchasing a home.

So, the next time you consider buying a property, remember that your down payment is not just an expense—it’s a stepping stone toward achieving your homeownership dreams. With the right knowledge and preparation, you can confidently take this step, paving the way for a brighter, more secure future in your new home.

Useful Resources:

- Learn more about down payment options and strategies from the Consumer Financial Protection Bureau.

- Explore the benefits of avoiding PMI with Investopedia.

- Get insights on calculating the right down payment for your situation with NerdWallet.