Have you ever wondered what happens when property taxes go unpaid? Enter the world of Tax Foreclosures. This daunting process might seem like just another bureaucratic hurdle, but it can have profound implications for property owners and communities alike. Whether you’re a homeowner, investor, or simply curious, understanding tax foreclosure is essential for navigating the property landscape. Let’s delve into what tax foreclosure entails, its processes, consequences, legal ramifications, and its impact on property ownership.

What is Tax Foreclosure?

At the heart of tax-related property issues lies Tax Foreclosure. But what exactly does that mean? In simple terms, tax foreclosure occurs when a property owner fails to pay the property taxes due on their real estate. Local governments rely on these taxes to fund public services, and when taxes remain unpaid, they have the authority to seize the property to recover lost revenue. This process is often seen as a last resort after all other options for tax collection have been exhausted.

The Process of Tax Foreclosure:

So, how does Tax Foreclosure actually work? Here’s a step-by-step guide to the process:

- Delinquency Notice: Initially, property owners receive a notice regarding overdue taxes. This is a formal reminder that taxes are unpaid and need immediate attention.

- Grace Period: Most jurisdictions offer a grace period during which property owners can pay the tax debt, often with additional penalties and interest.

- Public Auction: If the debt remains unpaid, the property may be auctioned off. The auction is typically public, giving buyers an opportunity to purchase the property.

- Redemption Period: Some areas allow a redemption period after the auction, during which the original owner can reclaim their property by paying the overdue taxes and additional fees.

- Ownership Transfer: If the original owner does not redeem the property, the new buyer receives a deed or title, completing the foreclosure process.

For those interested in a deeper dive into tax foreclosure procedures, this detailed guide from Investopedia offers an extensive overview.

Consequences of Tax Foreclosure:

What are the implications of a Tax Foreclosure for property owners? Here are some potential consequences:

- Loss of Property: The most immediate and severe consequence is the loss of property ownership, which can be devastating for homeowners.

- Impact on Credit: A tax foreclosure can significantly damage a property owner’s credit score, making it challenging to obtain financing in the future.

- Displacement: Homeowners may face displacement, leading to instability and potential housing insecurity.

- Community Effects: Foreclosures can affect community property values and lead to neighborhood blight if properties remain unsold or neglected.

For more insights into the impacts of tax foreclosures, explore this informative article from Bankrate.

Legal Considerations:

Understanding the legal framework surrounding Tax Foreclosure is crucial. Here are some key points to be aware of:

- Notification Requirements: Laws dictate how and when property owners must be notified about delinquent taxes and pending foreclosure.

- Redemption Rights: Some jurisdictions offer redemption rights, allowing property owners to reclaim their property post-auction under certain conditions.

- Lien Priority: Tax liens typically take precedence over other liens, meaning they must be settled before other debts.

- Jurisdictional Variations: Tax foreclosure laws can vary widely by state and locality, so it’s essential to understand the specific regulations that apply to your area.

To better understand these legal aspects, consider consulting this legal overview from Nolo.

Impact on Property Ownership:

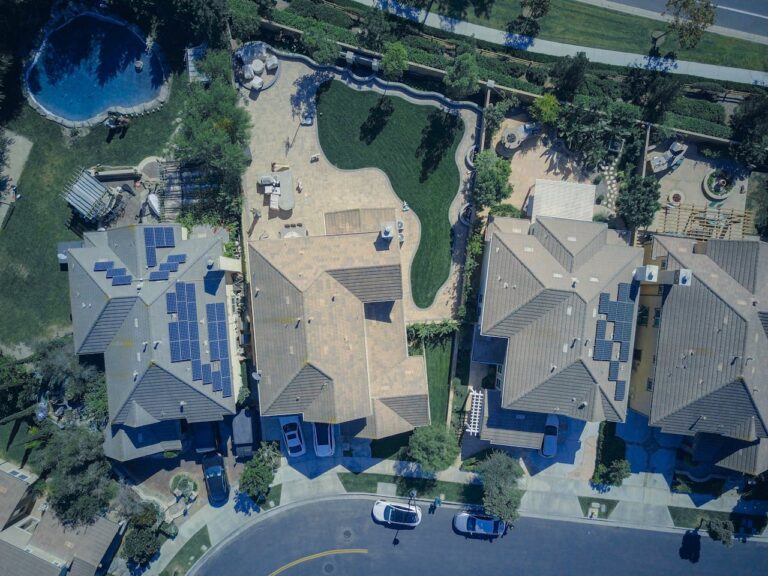

How does Tax Foreclosure influence property ownership and the broader market? Here’s what to consider:

- Opportunities for Buyers: For investors, tax foreclosures can offer opportunities to purchase properties below market value, though this comes with risks.

- Market Dynamics: A high number of foreclosures can indicate broader economic challenges and may influence local real estate markets.

- Community Revitalization: Properly managed, the purchase and renovation of foreclosed properties can contribute to community revitalization efforts.

- Estate Planning: For current property owners, understanding the risks of tax foreclosure is vital for effective estate planning and financial management.

Discover how tax foreclosures can impact the real estate landscape in this analysis by the New York Times.

Conclusion: Embracing Understanding in Tax Foreclosures

Ultimately, Tax Foreclosure represents a complex intersection of finance, law, and community dynamics. While it poses significant risks and challenges to property owners, it also offers unique opportunities for buyers and investors. By understanding the processes, legal considerations, and potential impacts, you can navigate the world of tax foreclosures more effectively and make informed decisions about property ownership and investment. Remember, knowledge is your most potent tool in managing and mitigating the risks associated with tax foreclosures.