Imagine this: You’re navigating the world of real estate, excited about your next investment. Suddenly, you encounter the term “Delinquent Taxes” and wonder what it means for your property dreams. Delinquent taxes refer to unpaid property taxes that have surpassed their due date. When left unresolved, they can lead to serious consequences, including liens on the property or even foreclosure. These taxes can impact both buyers and sellers, making it crucial to understand how they work and how to handle them effectively.

What Are Delinquent Taxes?

Let’s break it down: Delinquent taxes are essentially a financial hiccup that occurs when property taxes aren’t paid on time. We all have responsibilities, and paying taxes is one of them. But sometimes, life happens. Maybe you forgot, or maybe funds were tight. Whatever the reason, once taxes become delinquent, they usually incur penalties and interest, exacerbating the financial burden over time. Understanding the nuances of these taxes can empower you to make informed decisions and avoid potential pitfalls.

- Late Payments: Once taxes pass their due date, they’re considered delinquent.

- Penalties: These are additional charges imposed as a consequence of late payment.

- Interest Accrual: Over time, interest accumulates, increasing the debt.

For more details, check out what happens when you don’t pay property taxes.

How Do Delinquent Taxes Affect Property Owners?

So, how do delinquent taxes impact you as a property owner? It’s more than just an overdue bill. Unpaid taxes can lead to significant financial complications and affect your property rights. When not addressed, they can result in a tax lien, which is a legal claim against the property. This lien can hinder your ability to sell or refinance your property, and in worst-case scenarios, lead to foreclosure.

- Legal Claims: A tax lien can be placed on the property by the government.

- Sale Complications: Selling a property with delinquent taxes can be challenging.

- Foreclosure Risk: Persistent delinquency may lead to foreclosure proceedings.

For more on tax liens, visit IRS Tax Lien Information.

The Buyer’s Perspective: Red Flags and Opportunities

Are you a buyer looking at properties with overdue taxes? While it may seem like a red flag, it can also present unique opportunities. Properties with delinquent taxes might be available at a lower price, providing a chance for investment. However, it’s vital to approach such deals with caution and thoroughly research the property’s tax history.

- Price Negotiation: Unpaid taxes can lead to lower purchase prices.

- Research is Key: Understanding the tax history helps assess potential risks.

- Investment Potential: Some investors specialize in buying properties with tax issues.

Explore more about investing in tax-delinquent properties.

Strategies for Managing Tax Delinquencies

Facing delinquent taxes can be daunting, but there are ways to manage and resolve them. By taking proactive steps, you can mitigate the impact and protect your financial interests. Here’s a roadmap to guide you through:

- Early Action: Addressing delinquency early can prevent escalation.

- Payment Plans: Many local governments offer structured payment plans.

- Seek Professional Help: Consulting with a tax advisor or real estate professional can provide valuable guidance.

Answering Common Questions About Delinquent Taxes

Navigating unpaid taxes on a home can be confusing, so let’s tackle some common questions. Are you wondering how long before unpaid taxes lead to foreclosure? The timeline varies by jurisdiction, but typically ranges from several months to a few years. Another frequent inquiry is whether these taxes affect credit scores. While they don’t directly impact your score, a foreclosure stemming from unpaid taxes certainly will.

- Foreclosure Timeline: The timeframe depends on local laws.

- Credit Impact: Direct effects are minimal, but related foreclosure can harm credit.

- Resolution Methods: Options include payment plans and legal interventions.

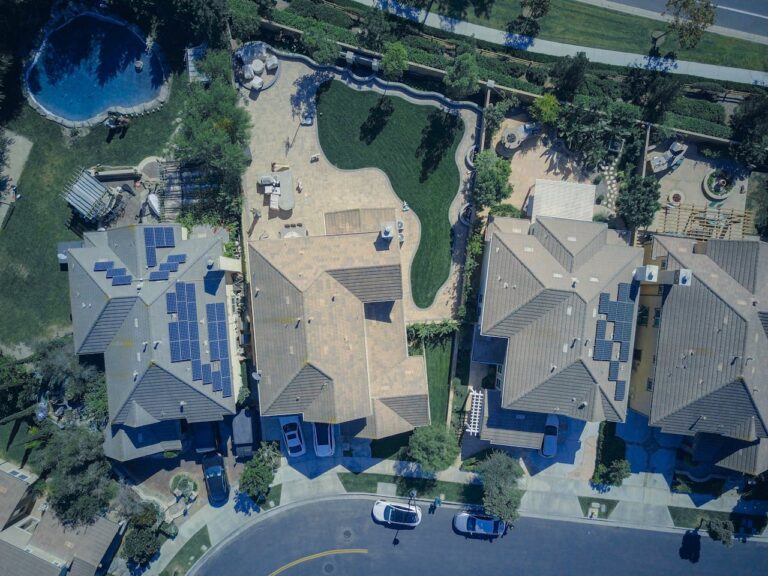

The Influence of Delinquent Taxes on the Real Estate Market

Tax delinquencies don’t just affect individuals; they also influence the broader real estate market. Areas with high rates of delinquent taxes might experience fluctuations in property values, creating both challenges and opportunities for investors. Understanding these dynamics can be crucial for anyone involved in real estate, from buyers and sellers to investors and developers.

- Market Fluctuations: High delinquency rates can affect property values.

- Investment Opportunities: Savvy investors might find deals in these markets.

- Community Impact: Delinquent taxes can affect local government resources and services.

Navigating the World of Delinquent Taxes

Delinquent taxes are more than just unpaid bills; they’re a crucial aspect of property ownership that requires attention and understanding. By educating yourself on the implications and solutions, you can safeguard your real estate ventures and seize opportunities that others might overlook. Ready to learn more? Explore our comprehensive guide on Managing Property Taxes.

Remember, understanding these taxes isn’t just about avoiding penalties; it’s about turning challenges into opportunities.