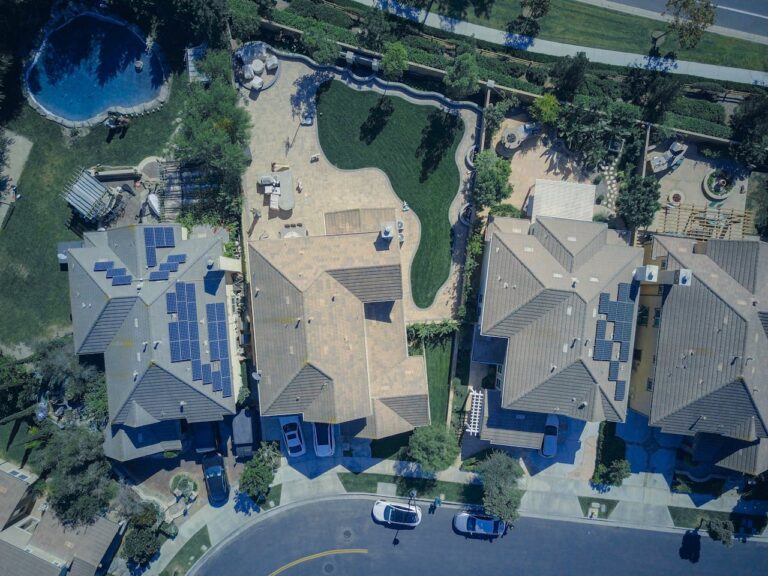

So, you’re thinking about selling your home or buying one? One critical step in this process is the home appraisal. A home appraisal determines the market value of your property and plays a crucial role in real estate transactions. Let’s break it down so you know what to expect.

What Is a Home Appraisal?

A home appraisal is an unbiased estimate of the true value of a home conducted by a professional appraiser. This process ensures that the property’s price aligns with its market value.

Why Is a Home Appraisal Important?

An appraisal protects both the buyer and the lender by ensuring the property’s value justifies the loan amount. Here’s why it matters:

For Buyers

- Peace of Mind: Ensures you’re not overpaying.

- Loan Approval: Lenders require it for mortgage approval.

For Sellers

- Pricing Strategy: Helps in setting a competitive price.

- Faster Sale: Attracts serious buyers when the price is right.

How Does a Home Appraisal Work?

The Process

First, the appraiser will inspect the property, assessing its condition, size, and features. Second, they will compare sales, looking at recent transactions of similar properties in the area. Finally, they evaluate market trends by analyzing the local real estate market.

Factors Influencing the Appraisal

- Location: Proximity to schools, parks, and amenities.

- Condition: Structural integrity and renovations.

- Comparable Sales: Recent sale prices of similar homes.

What Are Home Appraisal Costs?

Typically, a home appraisal costs between $300 and $500. However, various factors like property size, location, and complexity can influence this range.

Breakdown of Costs

- Standard Appraisal: $300 – $450

- Complex Appraisal: $500 – $1,000 (for unique or high-value properties)

Who Pays for the Home Appraisal?

Usually, the buyer pays for the appraisal as part of the mortgage process. However, you can sometimes negotiate this cost as part of the closing costs.

How to Prepare for a Home Appraisal

Tips for Sellers

- Clean and Repair: Tidy up and complete minor repairs to enhance the home’s appearance.

- Provide Documentation: Gather records of upgrades and repairs to present to the appraiser.

- Highlight Features: Make sure unique features are visible and accessible.

Tips for Buyers

- Research Comps: Look up comparable sales in the area to understand the market.

- Attend the Appraisal: If possible, be present during the appraisal to answer questions and provide information.

Common Issues with Home Appraisals

Sometimes, appraisals come in lower than expected. When this happens:

- Renegotiate the Price: Work with the seller to lower the price based on the appraisal.

- Challenge the Appraisal: Provide additional comps or request a second opinion to reevaluate the home’s value.

- Increase Down Payment: If committed, increase your down payment to cover the gap and proceed with the purchase.

Conclusion

Understanding the home appraisal process can make or break your real estate transaction. By knowing what to expect, who pays for it, and how to prepare, you can ensure a smoother experience.

For more detailed insights on home appraisals, check out our comprehensive guide.

Armed with this knowledge, you’re better equipped to navigate the complexities of home appraisals, ensuring a fair and accurate valuation of your property.