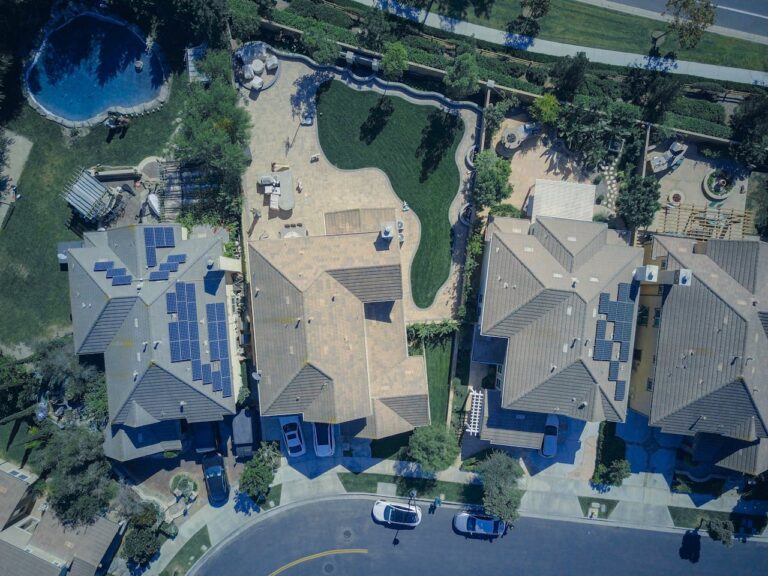

Curious about how some investors manage to flip properties without ever actually owning them? Welcome to the world of Real Estate Wholesalers. This unique niche in the property market can intrigue both seasoned investors and beginners alike. Whether you’re looking to dive into real estate with limited capital or interested in exploring new investment strategies, understanding the role and process of a real estate wholesaler can open new doors. Let’s unravel the concept, the mechanics, and the potential it holds for you.

What is a Real Estate Wholesaler?

At its core, a Real Estate Wholesaler acts as a middleman in property transactions. But what does that entail? Simply put, wholesalers identify properties under market value, secure them with a contract, and then assign that contract to another buyer, usually an investor, at a higher price. The wholesaler profits from the difference between the contracted price and the resale price. This method doesn’t require the wholesaler to actually purchase the property, making it an attractive option for those without significant capital.

The Process of Real Estate Wholesaling:

How does one step into the shoes of a Real Estate Wholesaler? Here’s a step-by-step breakdown:

- Market Research: Wholesalers begin by conducting thorough market research to identify undervalued or distressed properties that have potential for profit.

- Property Evaluation: Once a property is spotted, a detailed evaluation is conducted to ensure it fits the criteria for a profitable flip.

- Contract Negotiation: The wholesaler negotiates a contract with the property owner, securing the right to purchase the property.

- Finding Buyers: Wholesalers must have a network of potential buyers, often real estate investors, who are looking for properties to purchase.

- Assigning the Contract: The final step involves assigning the purchase contract to a buyer, who then closes on the property, allowing the wholesaler to earn a fee.

For those looking to delve deeper into the intricacies of this process, this comprehensive guide from BiggerPockets offers valuable insights.

Benefits of Real Estate Wholesaling:

Why consider becoming a Real Estate Wholesaler? Here are some of the key benefits:

- Low Capital Requirement: Since wholesalers don’t purchase properties themselves, they can enter the market with minimal financial investment.

- Quick Turnaround: Wholesaling offers a faster way to earn profits compared to traditional real estate investments.

- Skill Development: Wholesalers develop valuable skills in negotiation, market analysis, and networking, which are beneficial in broader real estate ventures.

- Scalability: As experience and networks grow, the wholesaling business can be scaled up to handle multiple deals simultaneously.

For more on the advantages of wholesaling, explore this article from Fundrise.

Challenges in Real Estate Wholesaling:

Every opportunity comes with its hurdles. What challenges do Real Estate Wholesalers face?

- Finding Deals: Locating undervalued properties that will appeal to investors can be challenging and requires ongoing research and effort.

- Building a Buyer Network: Developing a strong network of reliable buyers is crucial for success but takes time and trust-building.

- Legal Complexities: Navigating the legal landscape to ensure all transactions are compliant with local regulations can be daunting.

- Market Competition: The real estate market is competitive, and gaining a foothold among seasoned investors can be tough.

For an in-depth look at overcoming these challenges, check out this resource from HubSpot.

Legal Considerations:

Understanding the legal framework is essential for any Real Estate Wholesaler. Here are some key considerations:

- Contractual Clarity: Ensuring that contracts are clear and legally sound is crucial to avoid disputes.

- Assignment Clauses: Contracts should have an assignment clause that allows the wholesaler to transfer the contract to another buyer.

- Disclosure Requirements: Wholesalers must disclose their role and intentions to both sellers and buyers to maintain transparency.

- Local Regulations: Laws governing real estate transactions can vary significantly, so it’s important to be familiar with local regulations and seek legal advice when needed.

To better understand these legal aspects, consider reviewing this legal overview from Nolo.

Impact on the Real Estate Market:

What role do Real Estate Wholesalers play in the broader real estate market?

- Increased Liquidity: Wholesalers can help increase market liquidity by facilitating quicker property transactions.

- Access to Opportunities: They provide investors with access to off-market deals that might otherwise be inaccessible.

- Market Dynamics: Wholesaling can impact pricing and demand dynamics, especially in local markets with high investor activity.

- Economic Contributions: By turning around distressed properties, wholesalers can contribute to neighborhood revitalization and economic development.

Discover how wholesaling affects the real estate landscape in this analysis by The Balance.

Embracing the Role of Real Estate Wholesalers

In the realm of real estate, Real Estate Wholesalers provide a unique and dynamic approach to property investment. While the path is fraught with challenges, the potential rewards are equally significant. By mastering the process, understanding legal intricacies, and building robust networks, wholesalers can carve out a successful niche in the real estate market. Whether you’re an aspiring wholesaler or an investor looking for new opportunities, embracing the world of wholesaling could be your gateway to success in property investment. Remember, knowledge and adaptability are your strongest allies in this ever-evolving market.